Mudharabah is a financial contract agreement between two or more parites. The proportionate share in profit is determined by mutual agreement.

Mudarabah Contract In Islamic Finance Casakod

The other partner mudarib provides expertise and management.

. This contract is believed to come from the Arabic word darb which means walking and traveling on the earth. This is not the case in loans. A mudarabah is a legal person.

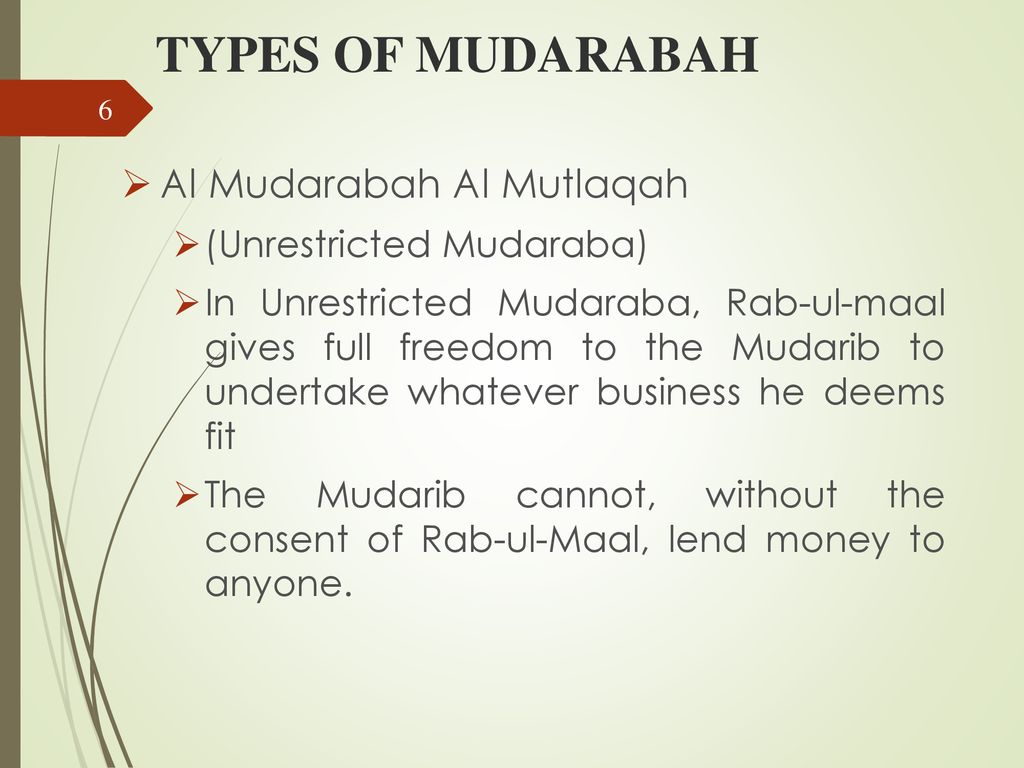

Mudarabah is an effective device for raising of large amount resources for productive purpose in place of joint stock companies. However if Rab-ul-maal gives full freedom to Mudarib to undertake whatever business he deems fit this is called Al Mudarabah Al Mutlaqah unrestricted Mudarabah. In this case.

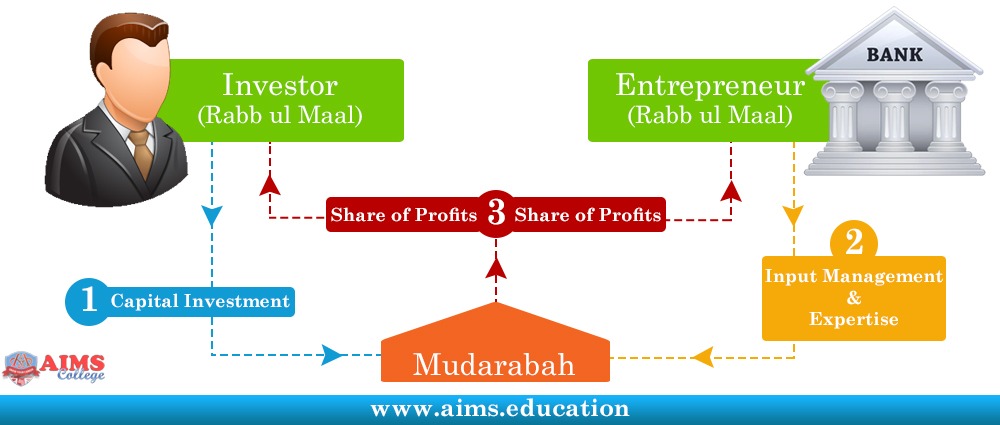

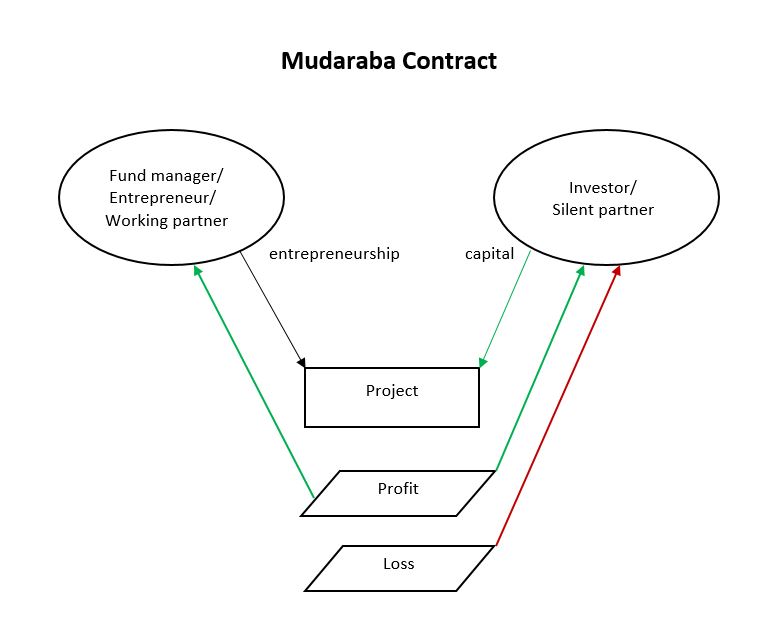

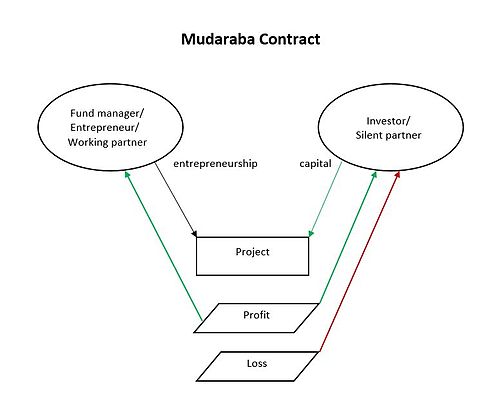

But the loss if any is borne only by the owner of the capital in which case the entrepreneur gets nothing for his labour. The Mudarabah contract is a partnership contract whereby the depositor or customer is known as rabbul mal who is seeking the investment opportunity and will invest through the bank that is known and act as mudarib who manage the fund. Registration of Mudarabah Companies.

Mudarabah is a special kind of partnership where one partner providers the capital rabb-ul-maal to the other mudarib for investment in a commercial enterprise. The term refers to a form of business contract in which one party brings capital and the other personal effort. In mudarabah you dont pay an interest instead your share of the profits is not 100.

In case of losses the entrepreneur must not bear any of loss es attributable to the invested capital. This is similar to how venture capitalists invest in. The partners will share profits according to the earlier agreement.

Al Mudarabah Al Mutlaqah. The profit of the business distributed divided to mudaribs and saheeb al mal based on a pre- agreed ratio which are mutually agreed to by the parties involved. In Islamic finance Mudarabah is a distinct type of partnership wherein one partner provides the capital to an entrepreneur another partner for investing in a commercial initiative with the objective of sharing profit from the commercial entity.

Mudarabah مضاربة is a type of partnership sharakah or musharakah for profit which is structured so that one partner known as rabb al-mal provides capital funds or mal and the other known as al-mudharib provides labor and expertise amal and khibrah. The main features of this are as under. Mudarabah means a partnership in profit in which one party provides capital Rab-al-Maal or Mudarabah Investor and the other party provides its expertise skill and effort in the investment of such capital Mudarib or Mudarabah Manager.

Unrestricted mudarabah Al-Mudarabah al-Mutlaqah It is a form of mudarabah contract where the capital provider doesnt restrict manager and give him full freedom in terms of capital administration. In mudarabah management or mudarib has a stake in the well being of the business because it gets a percentage of profits. They called Rabb al Mal owner of the capital and another party investing in a commercial venture they called Mudarib.

A joint venture agreement in which one party capital provider or rabb al-mal invests with capital and the other party entrepreneur or mudarib invests with his skill or labor. Murabaha also referred to as cost-plus financing is an Islamic financing structure in which the seller and buyer agree to the cost and markup of. WHAT IS MUDARABAH.

However Mudarib cannot without the consent of Rab-ul-Maal lend money to anyone. The mudarabah contract can be divided into two categories from the perspective of work limitations. Mudarabah the most-widely known Islamic contract is a profit sharing contract in which one party the Rab al Maal provides funds and the other the managing trustee the Mudarib or Ameel management expertise.

According to Mufti Taqi Usmani a mudarabah arrangement differs from the musharakah in five major ways. The first party Rabb al Mal provides 100 percentage money or fund for capital and another. Profit from the outcome of the venture is shared between the capital provider and manager.

One partner rabb-ul-mal is a silent or sleeping partner who provides money. It is a partnership contract between two parties where one party provides funds. Profit will be shared according to mutually agreed profit sharing ratio.

Mudarib is authorized to do anything which is normally done in the cour. There are two types of Mudarabah. The contract of Mudaraba is a profit sharing joint-venture where the Investor as Rab Ul Mal offers to provide funds to the managerBank as Mudharib to manage the funds Ras Ul Mal in Sharia compliant investments over a specific length of time.

A mudarabah or mudharabah contract is a profit sharing partnership in a commercial enterprise. The Mudarabah contract is a form of partnership between one who contributes efforts in the form of managerial skills Mudarib and the other who contributes capital Rabb-ul-maal. Restrictive Mudarabah means that the investor has specified investment details in the Mudarabah contract and has restricted the working partner within the scope of such specifications.

Profit if any is shared between the parties as per an agreed common ratio. Mudarabah is one of the most known Islamic contracts. It can sue and be sued in its name through the mudarabah Floatation and control Ordinance in 1980.

The partners will share the profit positive results according to the terms and conditions agreed to at the.

3 Reasons Why Mudarabah Financing Is More Ethical Than Loans Practical Islamic Finance

How Mudarabah Works In Islamic Banking And Finance Aims Islamic Finance Institute

Mudarabah Contract Mudaraba Types Examples Aims Uk

Mudarabah Lecture 04 Meaning Of Mudarabah Mudarabah Is A Special Kind Of Partnership Where One Partner Gives Money To Another For Investing It In Ppt Download

Financing Process Under Mudarabah Profit Sharing Contract Download Scientific Diagram

Mudarabah Mudarabah Definition Typesofmudarabah Differencebetweenmusharakahandmudarabah Differentcapacitiesofthemudarib Capitalofmudarabah Distribution Course Hero

Mechanism Of Two Tier Mudarabah Download Scientific Diagram

Financing Process Under Mudarabah Profit Sharing Contract Download Scientific Diagram

Fiqh Of Islamic Finance Musharakah Shirkah Partnership It

Mudarabah Contract In Islamic Finance Casakod

How Mudarabah Works In Islamic Banking And Finance Aims Islamic Finance Institute

Fiqh Of Islamic Finance Musharakah Shirkah Partnership It

Profit And Loss Sharing Wikiwand

Profit And Loss Sharing Wikiwand

Mudaraba Or Mudarabah Contract Definition Example Aims Uk Youtube